Focused innovation policy is key to lifting productivity

Frontier firms are the most productive firms in an economy and are vital to lifting national productivity and wellbeing. To best enable these firms to emerge and flourish, the Government should focus on building strong innovation ecosystems in a small number of high-potential areas.

A critical crossroads for innovation policy

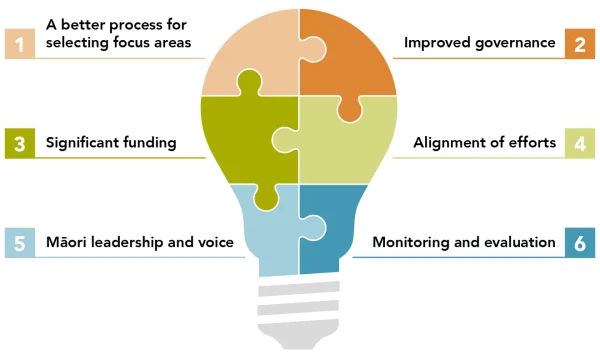

The Commission’s follow-on review noted that while some aspects of existing government processes and initiatives are promising, key elements needed for a successful focused innovation policy are lacking. These include a collaborative process for selecting a small number of focus areas; two-tiered governance arrangements with appropriate membership and decision rights; and substantial funding for each focus area.

While some progress has been made, existing arrangements, including those for developing industry policy and the research, science and innovation strategy (Te Ara Paerangi: Future Pathways) fall short - Industry Transformation Plans lack resources, co-investment by business, connections with researchers, and enough focus and ambition to spark transformational change. In addition, material decision making for Industry Transformation Plans, National Research Priorities, and other processes remain largely centralised and top-down, rather than being collaborative and devolved. Our 20 full findings are provided below.