New Zealand cannot afford to go it alone – Innovation around trade uncertainties

In this op-ed Dr. Denny Kudrna looks at how pooling information and coordinating investments in innovation and resilience can help the economy.

Supply chain disruptions highlight vulnerabilities created by specialisation and trade. These disruptions also reignite debates about whether to reduce our reliance on global supply chains and produce more closer to at home. The findings from the Productivity Commission’s inquiry into economic resilience highlight that disruptions are here to stay but also that New Zealand cannot afford to go it alone and reshore.

Globalisation was built on the fundamental assumption that economic interdependence ultimately fosters peace and prosperity. This assumption has been crumbling under the pressure of shocks since the global financial crisis fifteen years ago. This is unfortunate because as economies specialise in producing what they are good at, they also become dependent on other economies to supply all the other things that are needed.

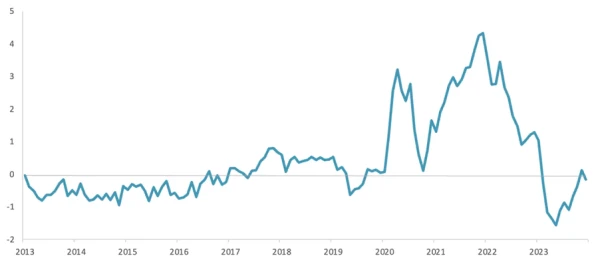

This exposure came to the fore as global supply chains came under enormous pressure after COVID-19, then improved, only to spike again due to the current events in the Red Sea [see Figure 1]. These see-saw shifts in supply chain pressures have been extreme, and current trends suggest that this volatility is becoming the new normal, reflecting the impacts of climate change and geopolitical upheaval.

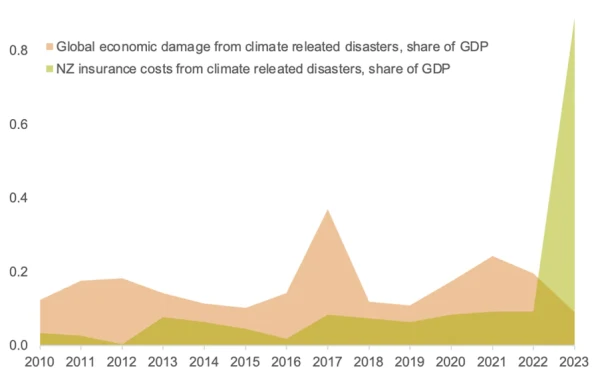

Insurance and reinsurance companies have skin in the climate change game and provide some of the most informative insights about where we are heading. Across the board, they report record losses, with extreme years becoming more frequent globally and in New Zealand [see Figure 2].

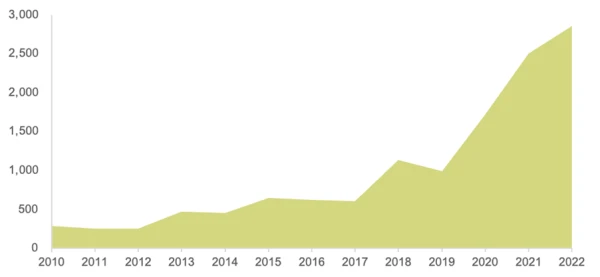

Evidence of trade barriers reveals an even more extreme uptick [see Figure 3]. A decade ago, the IMF counted only a few hundred new barriers each year. In the last five years, trade restrictions have counted in the thousands, and that is before including specific sanctions imposed on states, firms, and individuals. Some legal offices have had to introduce weekly trackers to help their clients stay on the safe side of these mushrooming complications to global trade.

Trade barriers mirror geopolitical tensions and the growing number of hot wars around the globe. Like climate change, geopolitics is unlikely to return to the relative stability of the last three decades, so trading internationally will be harder and more expensive.

In response to these changes, some governments have dusted off industry policy ideas to support onshoring some parts of global supply chains largely under the guise of economic security. While this might be an option for large, diversified economies the economic costs of doing so appear high. The jury is still out on their overall effectiveness as it turns out, for example, that computer chip production is tricky to relocate.

Smaller economies will always have to buy many goods and services overseas to maintain their living standards. They lack the scale and resources to onshore production. Instead, countries like Sweden, Denmark, or Singapore have doubled down on their existing policies that support innovation ecosystems of large and small companies that strive to capture global market niches.

From their perspective, supply chain disruptions are just another reason to innovate, replace vulnerable imports with a more secure ones, enter new markets to reduce dependency on existing trade relationships or develop technologies that are less reliant on long supply chains.

Spotting emerging trade disruptions early and understanding existing vulnerabilities is key to innovating our way from major exposures. There are a few obvious critical supplies like fuels, pharmaceuticals, and critical infrastructures like ports or cables. However, beyond these, the existing and experimental data techniques do not identify any fixed list of vulnerable products and services. They show a dynamic picture where a good, service or market vulnerable in one year seems fine in the next.

This reflects both changing preferences in the economy and the inherent resilience of firms in finding viable workarounds to temporary supply chain disruptions. However, economic network theories and practical experience from past shocks imply that some goods – such as Ad Blue or ball bearings - can create bottlenecks with massive economic impacts. Identifying these few goods and services requires a combination of data and industry expert insights.

Industry experts have an in-depth understanding of inputs, technologies and markets to say what might be critical enough to justify some form of public intervention. This need for the "experts with data" approach explains the reliance on the industry-government networks that exist in many of the small advanced countries. It is also why the Commission recommended strengthening existing networks in New Zealand and providing some competitive co-funding for these networks.

Adding resilience criteria into existing innovation funding schemes is also a way to ensure that firms and public agencies pay attention to the new risks and uncertainties plaguing global trade. New Zealand could also benefit from a skilled team of data and policy analysts within the public service and a long-term advisory group to help set a strategic direction on innovation and economic resilience.

While protecting what we have and onshoring might seem like a good first step toward economic resilience, anything that slows down adaptation, innovation, and the ability to grow into something new would be a miss-step for a small, distant economy. Pooling information and coordination of investments in innovation and resilience can provide a better bang for the buck.

The Productivity Commission report is available at productivity.govt.nz

Figure 1 Global supply chain pressure index, 2013 - 2024

Source: Federal Reserve Bank of New York, Global Supply Chain Pressure Index (2024)

Figure 2 Global and New Zealand natural disasters – economic damages and costs

Source: NZPC calculations based on CRED database and NZ Insurance Council data

Figure 3 New trade barriers on goods, services and investments

Source: International Monetary Fund