Annual report FY 2021/22

Table of contents

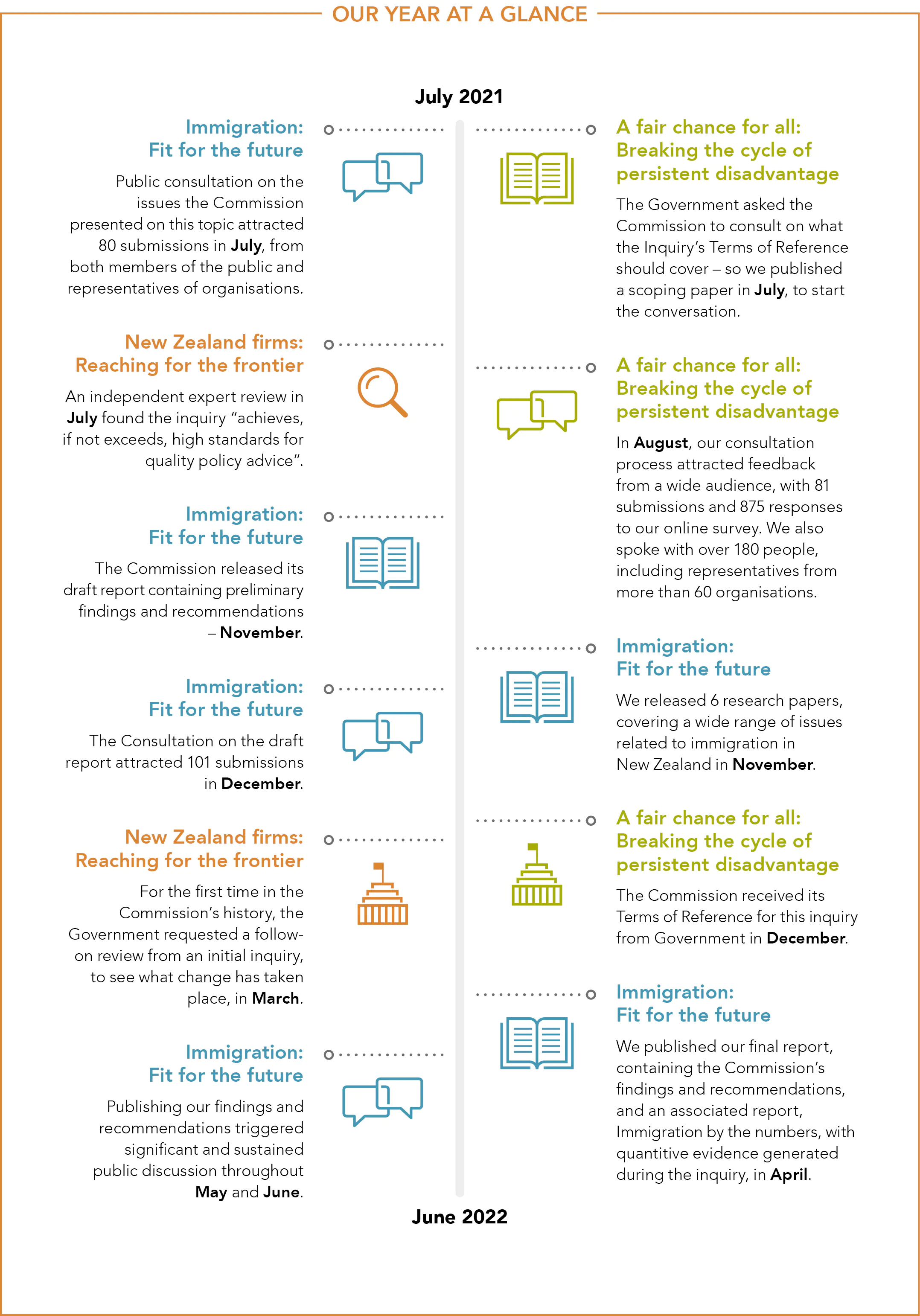

- Our year at glance

- Chair's message

- Who we are

- Our governance and capability

- How we measure our performance

- Our performance this year

- 2021-22 Statement of performance

- 2021-22 Financial performance summary

- Statement of responsibility for the year ended 30 June 2022

- 2021-22 Financial statements

- Our governance and management

Our year at glance

Chair's message

Ka tangi te titi

Ka tangi te kaka

Ka tangi hoki ahau

Tihei Mauri Ora

Tēnā koe,

I‘m pleased to present the Productivity Commission’s Annual Report for the 2021–22 year, one best described as a year of transition and consolidation.

The foundation for our mahi, to provide research and advice to lift productivity for the wellbeing of all New Zealanders, was set by the Minister of Finance in his Letter of Expectations in May 2021. The Minister requested the Commission extend its engagement programme to include a wider range of people, communities, and organisations. We were tasked to look at the longer-term picture, and cross-cutting policy issues and settings, while maintaining at our core, robust and rigorous analysis with recommendations informed by data and evidence.

We began the year with the hope that COVID-19 disruptions were behind us, and we could plan a return to more face- to-face engagements to assist our inquiry and research work. However, the ongoing impact of the pandemic required the organisation and our staff to innovate and adjust once more. These changes have been positive and become our new normal and have helped the Commission respond to intense staffing challenges in a highly competitive employment climate experienced by many public and private sector agencies this year.

In a challenging, but productive year, the Commission successfully delivered our Immigration inquiry, proposing novel solutions to long-standing issues. One of the key recommendations in our final report was ensuring immigration policy is connected to other government plans and objectives around investments in infrastructure and workforce. Alongside the Infrastructure Commission’s proposal for a population plan, and taking a much longer-term focus, we believe there is significant potential to progress towards our productivity and wellbeing aspirations.

Our staff ventured into new territory with a new inquiry, A Fair Chance For All: Breaking the cycle of persistent disadvantage. This inquiry required the Commission to engage with agencies, organisations and public prior to having a terms of reference agreed. The benefits from this process were positive, and we will take the learnings from this experience to continue to evolve our processes for future work. Ongoing work in this inquiry has continued at pace, with the Commission working hard to engage with a broader range of communities and to communicate the evidence and findings of our interim report.

The Commission received increased funding, which was used to increase the capacity and capability of our economics and research function. This gave the team a welcome boost, re-energising them to continue the value they provide to our inquiries, together with ongoing research and investigation into the links between productivity and wellbeing, at both the organisation and the sector level.

At a Commission-wide level, a refresh of our strategy builds on the foundation set over the first 10 years of the Commission. Following affirmation of our vision and purpose, we began developing areas of work to support a broader range of engagement in the community and to increase understanding of productivity. This included a stakeholder analysis and engagement plan; workforce retention and professional development programmes; building cultural competency and confidence; and clarifying governance, management and operations functions and responsibilities. This work is ongoing, and we will work on the establishment of success measures for reporting on in the coming year.

I look forward to an exciting year ahead as we work toward welcoming a new Commissioner to the team, establishing a new inquiry, completion of our A Fair Chance For All inquiry, and publication of the latest version of Productivity by the numbers.

It has been a fulfilling year with many highlights. I thank my fellow Commissioners for their assistance and contributions, and my wholesome congratulations to staff for all they have achieved during another challenging year.

Ngā mihi nui,

Dr. Ganesh Nana

Chair

New Zealand Productivity Commission | Te Kōmihana Whai Hua o Aotearoa

February 2023

Who we are

Our purpose

As embodied in the New Zealand Productivity Commission Act, 2010 the principal purpose of the Commission is to provide advice to the Government on improving productivity in a way that is directed to supporting the overall wellbeing of New Zealanders, having regard to a wide range of communities of interest and population groups in New Zealand society.

Our vision

To lift the productivity of New Zealand and the wellbeing of New Zealanders.

Our work

The Commission provides evidence-based, high-quality analysis and advice about ways to improve productivity in New Zealand. We aim to increase public and political understanding of productivity-related issues and to empower decision makers with the knowledge and solutions to influence and change policy.

Our work programme focuses on conducting inquiries and research on productivity-related matters and promoting public understanding of this. The Commission normally works on two inquiries in parallel.

Undertaking inquiries

Inquiries are big pieces of analysis, typically undertaken over 12 to 15 months. This timeframe recognises the importance of engaging extensively with interested parties and experts to ensure we consider all points of view, obtain the best available information, understand different perspectives, and test ideas. The Government chooses inquiry topics to ensure our work is relevant, and our advice pertains to issues they have an interest in addressing. Once topics are set, we are required to act independently.

Publishing research

The Commission conducts research and publishes papers to provide an evidence base on which to offer advice to improve New Zealand’s productivity. This work includes benchmarking New Zealand’s productivity performance over time, which is presented in our Productivity by the numbers publication. We collaborate and work closely with agencies who are active in productivity research. This allows us to access subject/sector specialists and benefit from the cross- promotion of ideas and insights.

Promoting understanding

We undertake a range of communications activities around our inquiries and research work to educate and promote understanding of productivity-related matters. We aim to reach diverse audiences through outreach activities, opinion journalism, blogging, sponsored media articles, social media and email marketing.

Our governance and capability

Our governance

The Commission has three part-time Commissioners: Dr Ganesh Nana (Chair), Prof Gail Pacheco and Dr Bill Rosenberg. As the Board, they are accountable to Parliament and report to a responsible minister within Government, currently the Minister of Finance. The Chair and Commissioners are responsible for the effective governance of the Commission. This includes the appointment and performance of the management team, setting and monitoring strategic direction, delivery of and conformance with accountability documents, integrity of processes and the overall health, wellbeing, and sustainability of the organisation (including oversight and management of reputation and risk). Commissioners also oversee the delivery of our work programme and outputs, shaping the scope, content, balance, quality, and presentation of our work.

Looking to the future

Currently the Commission is developing a new strategic plan that focuses on operational and organisational improvements. The high-level strategy developed to date is focused on four key strategic initiatives:

- Communicate and improve access to the Commission’s work.

- Execute comprehensive stakeholder

- Promote productivity and wellbeing

- Ensure our people, processes and systems are all fit for purpose.

The Commission is currently developing the objectives and action plans related to these initiatives and these will be published in our next Annual Report.

Our people

The quality of our people is critical to our success. The Commission aims to attract and retain strong performers in their field, or those who have significant potential to contribute to our research or inquiry work. We employ people who bring diverse skills, disciplines, and backgrounds to benefit our organisation. Once with us, we strive to provide a rewarding environment where excellence is valued.

We place high importance on supporting staff to develop to their full potential and encourage staff to plan and progress their personal development. There has been a growing awareness that deeper understanding of Te Ao Māori is an essential capability to develop in our workplace.

Across all staff positions we typically employ between 15 to 20 people with approximately a 50–50 gender split. They are employed on a mixture of permanent and shorter, fixed-term contracts. We supplement our permanent staff with consultants to bring experience and fresh perspectives, as required, and through secondments to take advantage of expertise across the public sector. We also encourage our staff to take up secondments to develop their skills and experience.

Looking to the future

The Commission retained an external HR company to review HR policies and interview former and current staff and make recommendations, following high turnover of staff in 2021 and the beginning of 2022. The recommendations made in the report were incorporated into operational changes and strategic action plans, to create a positive workplace culture and ensure retention of staff.

Our capabilities

Our work demands a high level of capability in areas such as sourcing information, analysis, process management, engagement, communications and influencing. These capabilities ensure the publication of insightful and influential analysis, findings and recommendations based on the right information from robust processes.

Our key capabilities are measured indirectly through our performance measurement and inform our internal priorities for capability development and the reputation we aspire to as an organisation. This is vital to ensuring our work makes a difference to lift the productivity of New Zealand to improve the wellbeing of New Zealanders.

| Supporting capabilities & systems | What we want to be known for | Our aim: to be an attractive place to work |

|---|---|---|

| Governance | Deep productivity knowledge | Valuing integrity, diversity and state sector conduct expectations |

| Leadership | High-quality, evidence-based analysis | |

| Culture & values | Skilful communications | Meeting "good employer" and EEO obligations |

| Policies | Participative processes | Safe and healthy working environment |

| Performance measurement | Even-handed, non-political approach | Open and transparent communication with our staff |

| Risk management | Workable & relevant advice |

We value diversity

The Commission values and embraces different and diverse ways of thinking and being. We aim for our thinking and actions to be informed by a diverse range of views from people, groups, and communities across Aotearoa New Zealand. We believe this approach is vital to enhance the credibility, value, and effectiveness of our work.

|

Our approach to diversity and inclusion |

|---|

|

We believe that a diverse and inclusive approach to policy development is vital to lifting productivity and wellbeing for New Zealanders. |

|

Our focus on diversity and inclusion will have a positive impact on our performance. |

|

We have a responsibility as an employer and advisor to lead and role model in this area. |

|

We recognise that we do not have all the answers and that we will make progress in this area through discussion, debate and feedback from our people and customers. |

|

We are prepared to try new things and learn from our mistakes. |

This year our Diversity and Inclusion Action Plan had two main goals: to develop a knowledge base on diversity and inclusion; and to take steps to build workforce diversity. Actions were progressed against these goals as follows:

1. Build initial information, knowledge, and awareness – to develop and promote a base of knowledge on diversity and inclusion.

- A baseline workplace profile was provided to Commissioners.

- A diversity and inclusion policy was drafted and will be finalised alongside our strategic refresh. This will be implemented with any necessary adjustments to our recruitment and employment processes.

- Identification and implementation of staff awareness and education tools for diversity and inclusion has been discussed with the leadership team and will be progressed in the coming year.

2. Take formative steps to build workforce diversity – to develop and promote a base of knowledge to support processes that enable the employment and retention of a more diverse workforce.

- We recognise the relative lack of women and Māori across the economics profession, and among senior roles. In response, we are trying to focus our recruitment on sourcing strategy(ies), channels, and advertising tools to attract a more diverse range of candidates. We are also pursuing development and leadership opportunities for women in the profession, including the encouragement of links to appropriate networks for staff.

- We developed a careers section on our website to better communicate the Commission’s offering, including our commitment to becoming an equal opportunities employer, and to grow our knowledge and appreciation of Te Ao Māori.

Our Diversity and Inclusion Action Plan for the year ahead will further progress this year’s goals, while incorporating new goals around improving accessibility, attracting more women and Māori, and building a culture and workplace that embraces Te Ao Māori.

Strategic risks and building our reputation

Vital to our strategic success are several attributes outlined below. We see our strategic risks as the inverse of not achieving or sustaining these key areas of success.

When we assess strategic risk, we consider the environment in which we operate in and how we want to be known in that environment:

| What we want to be known for | Strategic risk area | Our response |

|---|---|---|

|

Deep productivity knowledge |

Insufficient knowledge |

Our research function and inquiry work contribute to a deep understanding of productivity. Through our work and that of others, we will continue to enhance this knowledge. We must also continue to pursue improvement in those areas highlighted through our performance evaluation exercises and make time for staff to pursue professional and knowledge development. |

|

High-quality, evidence-based analysis |

Weak analysis |

The ongoing development of analytical capability will always be a priority for our overall performance. While high quality skills and experience in economics and public policy remain core requirements our mandate is broad indicating that intellectual and experiential diversity are also important considerations. |

|

Skilful communication |

Poor communications |

We are always assessing the relevance and utility of our communications approach and tools. This includes understanding how we can ensure that our messages are clear, accessible, and effectively presented. We recently updated our website to improve navigation and accessibility and to better communicate what we do and why. |

|

Participative processes |

Poor process and/or engagement |

Our engagement processes are often highlighted as a strength and a distinguishing feature of our approach relative to core government agencies. We are committed to continuous improvement, for example, our recently completed inquiry on Technological change and the future of work operated a different model with a series of short draft reports along with a blog that provided an alternative means of gathering views and reaching interested parties. |

|

An even-handed approach |

Bias and/ or loss of independence |

We actively engage with a wide range of individuals and organisations to ensure we are exposed to all points of view, get the best available information and understand different perspectives. We are committed to providing independent advice. |

|

Workable and relevant advice |

Seen as overly theoretical and lacking practicability |

The quality and workability of our recommendations will be an enduring focus. Overall, feedback to date indicates we are credible and influential through the quality and emerging impact of our work. It is critical that we remain focused on providing relevant and workable advice, and recommendations that can, with political will, be successfully implemented. |

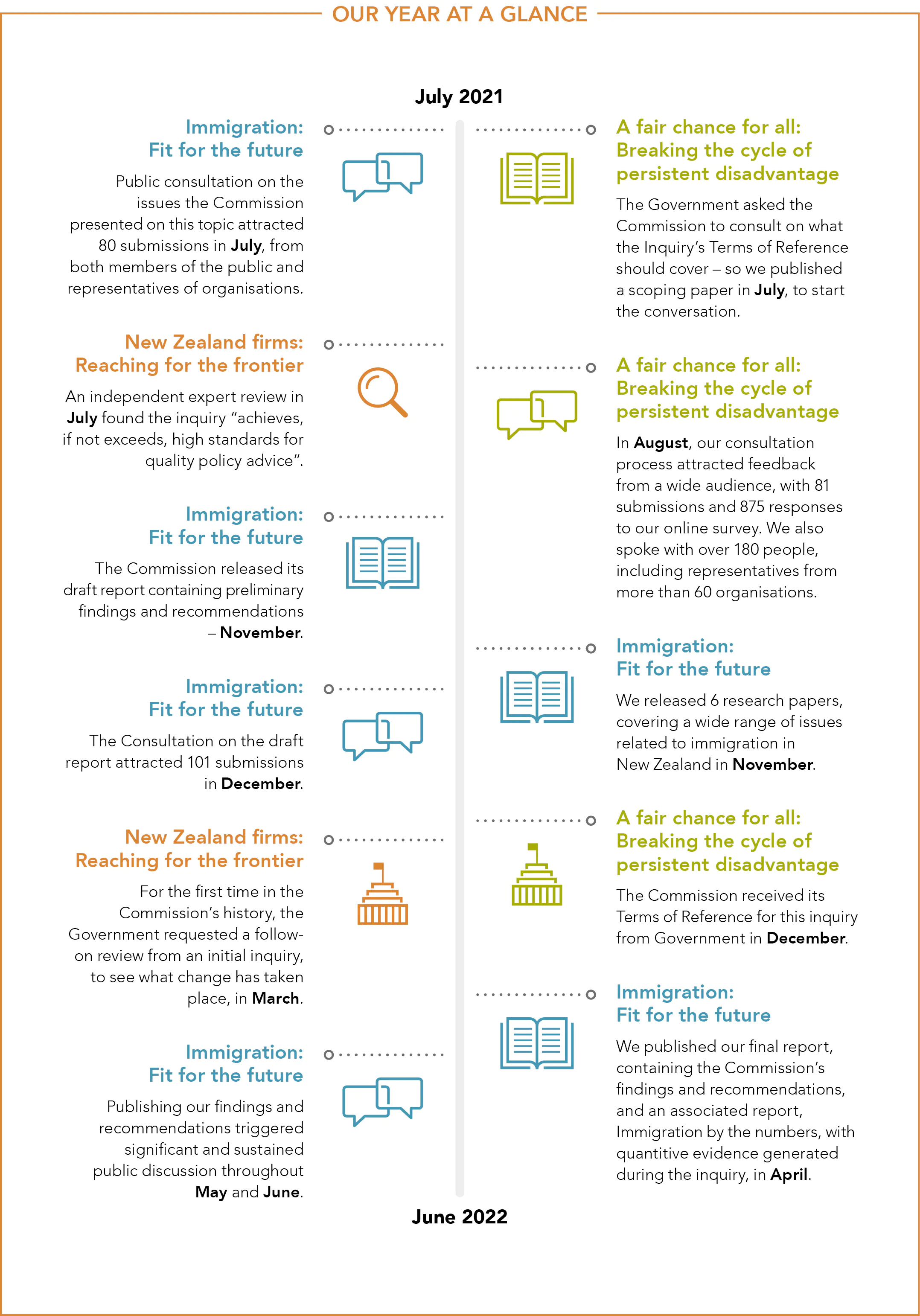

How we measure our performance

Making a difference: our outcomes framework

The Commission seeks to influence two strategic outcomes: to lift New Zealand’s productivity and, as a result, lift the wellbeing of New Zealanders.

Through our work, we:

- explore the causes of New Zealand’s weak productivity performance;

- identify the barriers to higher productivity and wellbeing; and

- recommend policies to overcome those barriers.

In producing and publicising research and reports, we aim to inform the public and decision makers, promote debate, and encourage the adoption of policies and behaviours that contribute to lifting productivity and wellbeing. To do this effectively, we must be trusted and provide rigorous and workable advice.

Central to the Commission’s impact and influence is our public consultation and engagement. During each inquiry we engage with a large and diverse group of experts, interested parties, communities, and groups across Aotearoa New Zealand, to provide direct input on specific policy issues and to test ideas. Identifying areas in which policy settings can be improved to enhance productivity and wellbeing is at the heart of the Commission’s work.

Our outcomes framework summarises how we expect to make a difference, along with the core capabilities and the reputation we wish to develop.

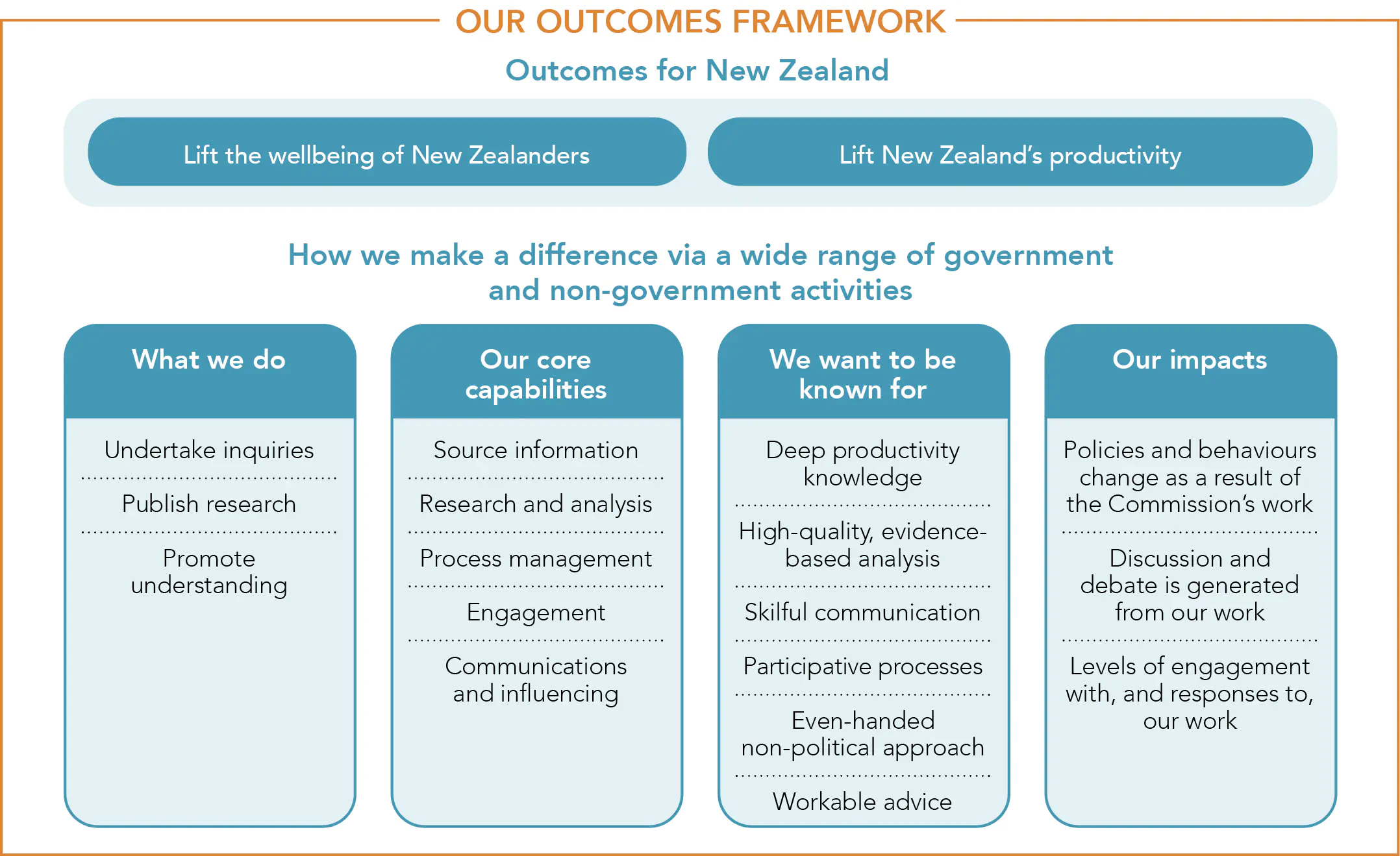

Measuring progress

Measuring the Commission’s progress and impact is challenging. Productivity operates at many levels, with many influences, which may take place over long timeframes. It can be difficult to identify improvements to productivity or wellbeing that can be directly attributed to our work.

The inquiries we work on, the types of analysis we conduct, and the range of community and industry groups we engage with, change significantly from year to year. It is difficult to capture this diversity of work and effort in fixed quantitative targets, so the Commission takes a strong evaluative- based approach to measuring performance.

Once each inquiry is finished, an independent review is done. Every two years an independent review evaluates our economics and research work.

These evaluations use the same output measures to ensure comparability, while ensuring flexibility to incorporate other feedback.

Evaluating performance

The Commission is an independent research and advisory body with no operational ability to run or implement policies. The Government is under no obligation to implement our recommendations, nor to respond to our reports. We rely solely on our ability to skillfully communicate our ideas and our analysis to influence and shape policy.

| Our evaluation methods |

|---|

|

Independent expert review by someone with significant policy and/or productivity research experience, who is familiar with our role and functions. Survey of external participants using a set of questions covering multiple aspects of our work, such as the quality of our analysis and clarity of our communication. Stakeholder focus group(s) of about 6–10 attendees from different backgrounds, independently facilitated and without Commission attendance. Monitoring external feedback and internal workflow processes to capture, share and evaluate feedback received and external responses to our work (in the media, Parliament etc). [Note: all performance evaluations are published on our website.] |

| Our output measures |

|---|

|

Intended impacts – what happens because of our work Right focus – the relevance and materiality of our inquiry and research reports Good process management – the timeliness and quality of our work High-quality work – the quality of our analysis and recommendations Effective engagement – quality of engagement with interested parties Clear delivery of message – how well our work is communicated and presented Overall quality – the overall quality of the work considering all factors |

This influence may be direct and immediate (e.g. through academic, community, public and political recommendation) or over a longer period, after policies are adjusted or adopted.

We do not just produce reports. Analysis and commentary in our reports is disseminated, understood, and used to influence policy and behaviour so that New Zealand improves productivity in the long term.

Achieving policy impact and progress on New Zealand’s productivity and wellbeing performance may only emerge over time. To report on our strategic outcomes, we therefore focus on what analysis and advice we undertook that contributed to increasing the understanding of New Zealand’s productivity challenges.

Our approach to performance measurement

Our approach to performance measurement can be summarised as follows:

| Work programme |

|---|

|

Inquiries into and research on, and promoting understanding of, productivity- related matters. Assessed via: • Expert review • Survey • Focus group • Monitoring |

| Output measures |

|---|

| Right focus |

| Good process management |

| High-quality work |

| Effective engagement |

| Clear delivery of message |

| Overall quality |

| Impact indicators |

|---|

| Policies and behaviours change as a result of the Commission’s work |

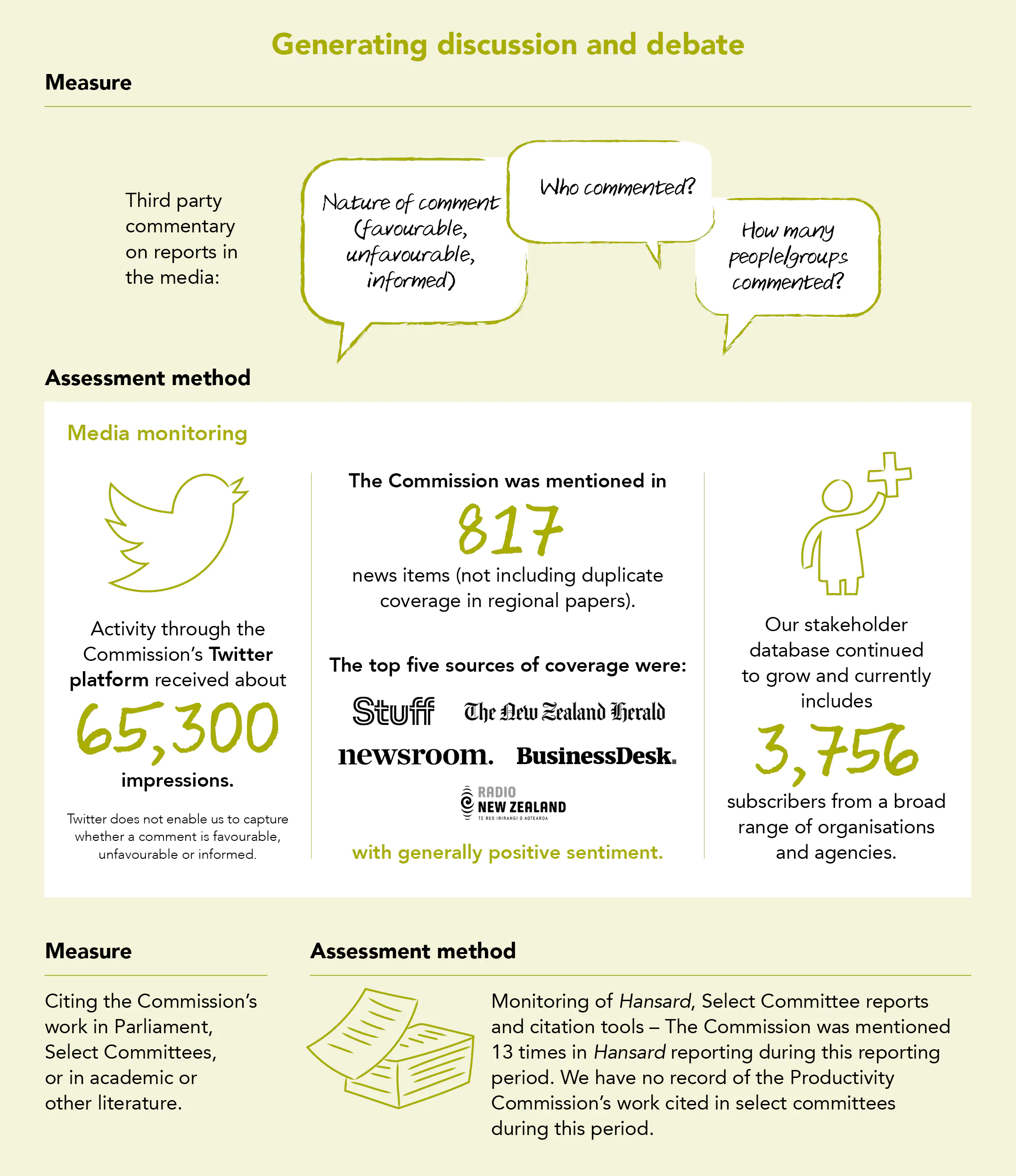

| Generating discussion and debate |

| Levels of engagement and response |

| Outcomes sought |

|---|

| Lift the wellbeing of New Zealand |

| Lift New Zealand’s productivity |

Our performance this year

Reporting on our outcomes

Lifting productivity of New Zealand and lifting the wellbeing of New Zealanders

|

Outcome |

Measure |

Assessment method |

Location of reporting |

|---|---|---|---|

|

Lifting the wellbeing of New Zealand; and lift New Zealand’s productivity |

Volume and quality of formal and informal research output (e.g. inquiry reports, research working paper series, and broader commentary on trends in New Zealand productivity and wellbeing such as our regular Productivity by the numbers report) |

A summary of performance evaluation material relevant to the year under review (e.g. expert reviews, surveys, and focus group reports of formal and informal outputs). |

See pages 18–45 |

|

Monitoring and review of Government responses to inquiries and Cabinet minutes and ongoing follow-up with implementation agencies. |

See page 14 |

||

| Monitoring of media (including social media) commentary on formal and informal outputs. | See pages 16 and 22 | ||

| Monitoring of Hansard, Select Committee reports and citation tools on formal and informal outputs. | See pages 16 and 22 |

Publishing research

Our research team has been focused on primary research to support our understanding of the inquiry topics. This has included work on how migrants contribute to productivity in New Zealand, migrant labour market pathways and outcomes, and income mobility patterns in New Zealand. The results from these research projects have fed into the work of our Immigration and A Fair Chance for All inquiries. The results were presented at the New Zealand Association of Economists annual conference, as well as several other public seminars and lectures. At the end of this reporting period, they were being prepared for publication as working papers and in peer-reviewed journals.

Penny Mok and Gail Pacheco’s paper Income Protection in the New Zealand Tax-transfer System was published in the peer-reviewed journal New Zealand Economic Papers.

Income Mobility in New Zealand 2007–2020: Combining Household Survey and Census Data, by John Creedy and Quy Ta was featured in the Working Papers in Public Finance series by Victoria University of Wellington in May 2022.

Immigration by the numbers is a comprehensive collection of the immigration trends and quantitative analysis that informed the Commission’s inquiry into immigration settings for New Zealand’s long- term prosperity and wellbeing. The style of the report was built on last year’s successful Productivity by the numbers publication.

We restarted the Productivity Hub1, in collaboration with the Government Economics Network. This includes a Research Leaders Group2, to bring together research leaders from across the government sector. This group includes representatives from Treasury, the Ministry of Business, Innovation and Employment, the Ministry of Foreign Affairs and Trade, New Zealand Infrastructure Commission, Te Puni Kōkiri, the Social Wellbeing Agency, Statistics New Zealand, the Ministry of Transport, and the Reserve Bank of New Zealand.

Undertaking inquiries

Two new inquiries were assigned by the Minister of Finance shortly after the completion of our Frontier Firms inquiry in April 2021.

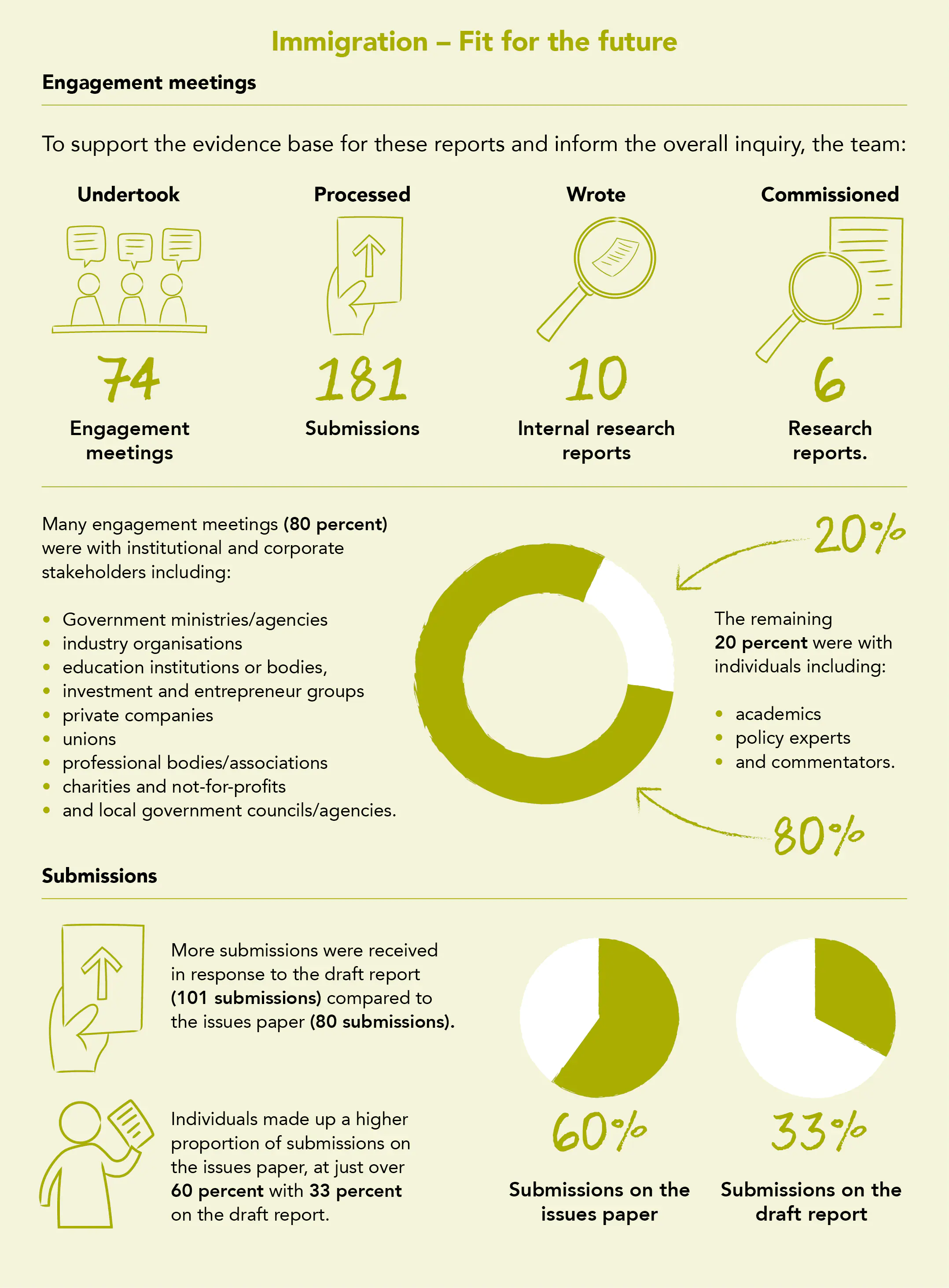

Immigration: Fit for the future

The Commission received the terms of reference (ToR) from the Minister of Finance for the Immigration inquiry on 12 April 2021. The ToR alongside the inquiry’s call for submissions and issues paper (released in June 2021) set the scene for this work programme from July 2021 to June 2022.

A Fair Chance For All: Breaking the cycle of persistent disadvantage

In June 2021, the Government asked the Commission to scope a new inquiry into the drivers of persistent disadvantage within people’s lifetimes and across generations. As part of scoping, the Government asked us to consult the public on what the terms of reference should cover – a new approach for the Commission. To assist with this, a scoping paper was published on 21 July, with submissions and feedback due by 27 August 2021.

From January through to June 2022 we undertook work to inform the development of our interim report. This included commissioning and/or releasing the following pieces of research:

- Together alone – a review of joined up social services (by consulting economist Julie Fry).

- Te puna kōrero: Understanding persistent disadvantage in Aotearoa New Zealand – a thematic review of existing research into the lived experiences of people living in persistent disadvantage.

- A report on colonisation, racism, and wellbeing, prepared by Haemata

- Analysis of family resources across the early life course and children’s development in Aotearoa New Zealand, using the Growing Up in New Zealand study data set, undertaken by Dr. Kate C. Prickett, Dr. Sarah-Jane Paine, Associate Professor Polly Atatoa Carr Te Ngira and Professor Susan Morton.

We also undertook our own quantitative analysis into persistent disadvantage, linking the Census and the Household Economic Survey, and collaborating with Dr John Creedy at Victoria University of Wellington to examine income mobility patterns in New Zealand over the short to medium term.

The inquiry’s interim and final reports are due to be published in 2022 and 2023 respectively.

New Zealand Firms: Reaching for the frontier

Evaluation – July 2021

Our final report on the Frontier Firms inquiry was published in May 2021. Institute of Directors, General Manager, Guy Beatson conducted an independent expert review of the inquiry and the final report. We also used an online survey and two independently chaired focus groups and interviews with inquiry participants to evaluate the inquiry and final report. These were all published on our website in July 2021.

The expert review found that, overall, the final inquiry report achieved, if not exceeded, high standards for quality policy advice. The review also found we should continue with some practices from the Frontier Firms inquiry to improve our inquiry practice in other areas.

Most focus group participants and interviewees viewed the inquiry favorably. Our staff, engagement and inquiry process drew positive comments. The inquiry’s Māori engagement was welcomed and regarded as appropriate and of a high quality. Our engagement with Māori was useful for our analysis, findings, and recommendations, and promoted goodwill.

Government response and request for a follow-on review – March 2022

The Government released its official response to the Frontier Firms inquiry in March 2022, thanking the Commission for a well-researched, well-evidenced, coherent, and practical inquiry. The Government also appreciated us challenging it to think about where and how to focus its efforts and help guide its economic strategy towards a more productive, sustainable, and inclusive economy.

In its response, the Government asked us to undertake a “follow-on review of Government’s policy settings in 12 months, to determine whether we are shifting the productivity dial and progressing towards a more sustainable and inclusive economy, or whether more radical change is needed.”

We are undertaking this follow-on review from September 2022 to March 2023.

Promoting understanding

We published the draft report of the Immigration– Fit for the future inquiry with our preliminary findings and recommendations in November 2021.

The final report was delivered to the Minister of Finance, on 30 April 2022, with our findings and recommendations, together with an associated report (Immigration by the numbers) containing much of the quantitative evidence generated during the inquiry.

The public rollout of the findings and recommendations of the Immigration inquiry began in June 2022, and included webinars, media activity and a range of public events and meetings with key stakeholders. Ten events were held in June, including two that were open to the public – a launch event on 10 June (attended by 140 people) and a seminar organised in association with Motu Economic and Public Policy Research on 16 June.

Several organisations hosted meetings to discuss the inquiry’s final reports, including NZCTU, FOMA Chairs, Workforce Development Councils, the Employers and Manufacturers Association Members Forum, NZ Aged Care Association, Education New Zealand (the International Education Chief Executives Group), MBIE’s Policy Forum, the Treasury’s Economic Strategy Team (as well as a guest lecture at the Treasury), the Stats NZ DataLab User Forum, and the New Zealand Association of Economists Conference in late June.

An evaluation for the inquiry, including an expert review, focus group evaluation and public survey was undertaken and published on the Commission’s website.

In addition to supporting our inquiries, our E&R team also completed the following pieces of work:

Migration and productivity

Research by the Commission examined how migrants contribute to productivity in New Zealand. Using administrative data on the flows of migrants into and out of New Zealand, visas, earnings, and jobs between 2004 and 2019, our research compared migrant workers with NZ-born workers. Through the lens of a derived ‘productivity-wage gap’ we captured the difference in relative contribution to output and the wage bill. The research found that skilled and long-term migrants make contributions to output that exceed moderately skilled New Zealand-born workers. The higher contribution is likely due to a mix of skill differences and/or effort that is largely reflected in higher wages.

We found tentative evidence that Māori highly skilled NZ-born workers make a stronger contribution to output when they work in firms with higher migrant shares, which suggests complementarities between the two groups or, at least, positive mutual sorting of these groups into higher productivity firms.

Migrant spells and transitions

The Commission examined recent migration trends in New Zealand, focusing on the visa spells and transitions. Visa spells are the time spent by migrants on a visa when they enter and work in New Zealand. Visa transitions describe when migrants change status, such as changing visa category, becoming a New Zealand citizen, or leaving the country. The work looked at visa spells and transitions for migrants arriving between 2000 to 2020, focusing on groups based on the years migrants first arrive. We found that most migrants enter and stay only a year or two before leaving.

Only a small number of migrants ‘visa-hop’ between multiple visas with most only holding two different visas. Many migrants leave after several years in New Zealand. Of those who stay, there has been an increasing trend towards spells on temporary work or student visas before gaining residence visas.

Migrant selection and outcomes

The Commission explored differences in the selection for permanent residence, where employers select for temporary visas in the first stage (demand driven) and the Government controls the second stage (human capital-based selection) through a points-based system. We compared earnings and employment outcomes between residents applying from offshore and those applying from temporary working visas. We looked at the extent to which skilled or highly paid migrants are reflected in selection and investigated whether there is any earnings advantage to pre-residence earnings over time, or whether there is a catch-up with time in New Zealand.

Changing family incomes in New Zealand

This work was conducted in collaboration with the Victoria University of Wellington. The work examined income mobility patterns in New Zealand over the short to medium term. We used a special dataset that tracked the Household Labour Force Survey over the period from 2007 to 2020, using 2013 census data. Just below half of those initially in the bottom decile remained either there or in the second-lowest decile over seven years, while about two-thirds of those initially in the top decile remained either there or in the second-highest decile.

2021-22 Statement of performance

Our approach

To measure our performance, we use a strongly evaluative approach that best aligns with the nature of our work. For our research and inquiries, we collect qualitative and quantitative information through independent expert evaluations, participant surveys and focus groups or interviews.

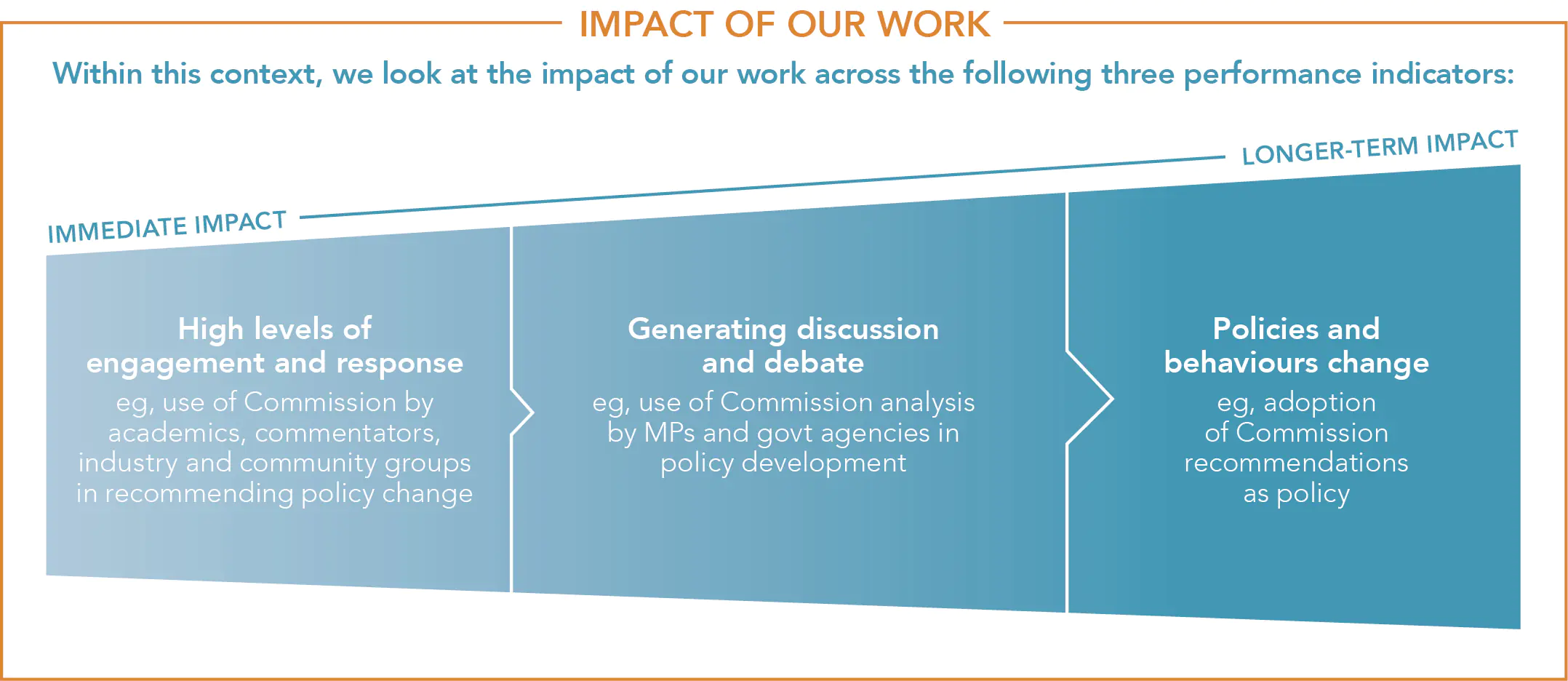

As per our Statement of Performance, our performance is measured against three broad impact indicators:

- Policies and behaviour change because of our work;

- Discussion and debate are generated from our work;

- Levels of engagement, and responses to, our work.

We then measure our outputs against the following categories:

- Right focus;

- Good process management;

- High-quality work;

- Effective engagement;

- Clear delivery of message;

- Overall

The evaluation, participant surveys and focus groups for the A Fair Chance For All inquiry will be included in the 2024 Annual Report.

Immigration – Fit for the future inquiry process and final report

An independent evaluation of the Immigration inquiry was undertaken to assess the Commission’s performance and learnings for the future. Three external sources of feedback were used – an expert review, focus groups and an online public survey.

The expert review was carried out by Richard Bedford, of Bedford Consulting. All evaluation documents are available on the Productivity Commission website.

The focus group report, prepared for the Commission by Kathy Spencer, collected feedback from 12 people representing industry groups and other stakeholders who were actively involved in the inquiry process. The focus group process included individual interviews, and two small group sessions.

Participants included representatives from Restaurant Association of NZ, Federated Farmers, BusinessNZ, Human Rights Commission, Unite Union, NZNO, University of Otago, E Tū, Aims Global, Asia New Zealand Foundation, Migrant Investor and Entrepreneur Association, and FIRST Union.

The survey, open to the public and promoted through the Commission’s communication channels (including to participants), was run by Survey Monkey through the Commission’s website. It attracted 99 participants in total.

Biennial review of Economics and Research team

Every two years our economics and research function undergo independent review to evaluate the work completed during that period. Professor Robert Buckle completed the sixth review of our Economics and Research team (ERT). Having conducted the previous two reviews (2018 and 2020), Prof Buckle was able to consider how we had responded to his previous recommendations.

During the last two-year period, the ERT received very little funding and was reduced to a single person reporting to a Commissioner as an interim measure. More recently the team has experienced some growth.

The 2020–22 review is available on the Productivity Commission’s website.

“The team is perhaps the strongest it has been for several years.”

Prof Buckle noted that with “the support of the Board and additional financial support”, the Commission had been able to “markedly improve the level of research experience, skill and capacity.” He noted:

- the quality of the research published is of a high standard – it is valuable and valued;

- the development of a work programme that aligns its contributions with the requirements of the Commission’s inquiries, while also enabling the ERT to spend a significant amount of time working on other important productivity topics;

- methods of work involving deeper cooperation, and “significant research and leadership contributions” were made by the team to the Commission’s inquiries;

- there has been an increase in the quality of engagement and collaboration with other stakeholders, particularly those in Government policy agencies.

Impact indicator: Policies and behaviour change because of the Commission’s work

The proportion of our inquiry recommendations implemented by the Government, are the most direct measure of the impact of our work. The Government is under no obligation to implement our recommendations or respond to our reports. However, in practice and in most cases, the Government has issued formal responses to our inquiry reports specifying which recommendations it agrees with and will implement.

As an independent organisation with a strong focus on public interest, we are expected to push the boundaries on complex issues. Done well, our inquiry reports should spark a recalibration of thinking within relevant agencies and other stakeholders. We aim to put difficult issues on the agenda and encourage discussion and action on topics that other agencies consider too sensitive. We will continue to test ideas and challenge the status quo in the interest of improvement. Our focus is on providing the best advice, rather than the most palatable advice.

We look for evidence that our work is increasing understanding of productivity- related matters. We consider this a precursor to increased uptake and understanding of our recommendations that will ultimately lead to better decision- making on the policies and programmes that could lead to improved productivity and wellbeing. We mainly look for this evidence through independent evaluation of our work (via participant surveys, independent expert reviews and focus groups), but also by observing data around our connection and communication with audiences interested in our work.

Impact indicator: Policies and behaviour change because of the Commission’s work

Impact(s) - Policies and behaviour changes because of our work

|

Measure |

Assessment |

|---|---|

|

Commission recommendations explored, agreed, and implemented: • How many inquiry recommendations were agreed and implemented? • How fully were the recommendations implemented or actively explored by the relevant policy makers? |

Last year the Immigration inquiry made a series of recommendations to Government, no formal response has been received. |

|

Understanding of productivity- related matters increases |

Surveys, focus groups and expert review undertaken for the Immigration inquiry. Expert peer review undertaken on the E+R team (Biannual). |

Immigration – Fit for the future inquiry process and final report

Assessment methods: Independent expert review, focus groups, survey

|

Understanding of productivity-related matters |

|

|

Survey results |

Most survey respondents said the inquiry had increased their understanding “a little” or “a lot”. Responses to specific statements from the 74 respondents were as follows: • Immigration has played an important part in New Zealand’s economic development: 45.8% a little; 35.1% a lot. • On average, immigration is not driving down wages or replacing local workers: 37.8% a little; 35.1% a lot. • The immigration system currently uses a range of tools that may supress wages, job creation, and productivity: 41.9% a little; 32.4% a lot. • The Government should use an Immigration Government Policy Statement to improve the quality and transparency of immigration policy: 36.5% a little; 52.7% a lot. • The Government should engage with Māori in good faith on how to reflect Te Tiriti o Waitangi in immigration policy and institutions: 33.8% a little; 45.9% a lot. • The Government should improve the prospects of local workers instead of restricting immigration to prevent potential job displacement: 41.9% a little; 43.2% a lot. |

|

Expert reviewer (Richard Bedford) noted: |

In its ‘Briefing for the Incoming Minister (BIM) of Immigration’ in June 2022, MBIE refers to the Productivity Commission’s inquiry on pg. 4, noting that “the Productivity Commission has several findings and recommendations for the immigration system. You will receive advice on a government response in August”. It will be interesting to see how many of the Commission’s recommendations relating to immigration policy tools, including preparation of an immigration Government Policy Statement, are adopted by the immigration policy teams within MBIE’s Labour, Science and Enterprise Group. (pg. 4 of expert review) |

|

Focus group |

All participants wanted the Commission’s final report to have an impact on policies and behaviours, however, no-one felt fully confident that would happen: “I haven’t seen any changes based on the Commission’s report so far, but hopefully that will happen.” One person commented that while the rebalance had made some changes to allow migrant workers some ability to change employers, there were still a lot of barriers to doing that. People were looking for more acknowledgement of, and response to the inquiry from both the Government and MBIE. Decisions on sector workforce agreements and the Green List had cast doubt over how much influence the inquiry would have. On a more positive note, it was acknowledged that work on immigration is ongoing and that there will of course be further policy changes and working groups to address particular issues in the future. Participants and their organisations planned to make good use of the Commission’s inquiry, especially the data, in those ongoing processes. |

Biennial review of Economics and Research team

Assessment methods: Independent expert review

|

Understanding of productivity-related matters |

|

|

Expert reviewer (Professor Robert Buckle) noted: |

No formal evaluation processes have been carried out as no inquiries were completed during this reporting period, due to the timing of the inquiry process. With each inquiry taking 18–24 months, work carried out during this year will be evaluated in the 2022–23 Annual Report. |

Impact indicator: The Commission’s work generates discussion and debate

Where our work generates discussion and debate, we are interested in seeing the diversity of voices in that debate, how our work is being used by people (influencers), particularly those providing commentary on, or input into, policy. We look at how and where our work is cited in Parliament, by academics, industry commentators and the media.

Immigration – Fit for the future inquiry process and final report

Assessment methods: Independent expert review, focus groups, survey

|

Third party commentary and reporting in the media |

|

|

Survey |

Of the 84 members of the public responding to the survey, they largely agreed that the Commission had engaged with the appropriate people and had consulted the correct information during the inquiry. • Sourced all relevant research and information: 47.6% (40) agreed; 17.9% (15) strongly agreed; 22.6% (19) didn’t know. • Engaged with the right people: 40.2% (33) agreed; 12.2% (10) strongly agreed; 31.7% (26) didn’t know. • Engaged effectively and appropriately with Māori organisations and individuals: 21.7% (18) agreed; 9.6% (8) strongly agreed; 62.7% (52) didn’t know. |

|

Expert reviewer (Richard Bedford) noted: |

Extensive media coverage followed the public release of the Commission’s findings and recommendations on 31 May 2022. There were over 110 references to these in the print media, on radio and television, and in online outlets between 31 May and 1 September. This high level of interest in the findings of the inquiry is hardly surprising given the attention in the media to immigration generally at this time with the progressive opening of the border and the implementation of the Accredited Employer Work Visa system. There has not yet been an official response from the Minister of Immigration to the inquiry’s findings and recommendations, but it is clear from the media coverage that these have generated considerable discussion and debate about immigration. |

|

Focus group |

Participants thought the Commission’s final report needed and deserved wide distribution, with some saying immigration tended to be seen more negatively than positively, and the Commission’s report could help to change that. The finding in the Commission’s report that immigration did not, on average, drive wages down was seen as particularly helpful to address a widespread misperception. However, some were worried the report would “get lost on the shelves and gather dust”, with the focus switching to the immigration rebalance of 11 May. In general, people were disappointed by the amount of discussion and debate generated by the inquiry. “I haven’t seen much debate after the initial launch.” “It was always going to be limited due to the narrowness of the report.” |

Biennial review of Economics and Research team

Assessment methods: Independent expert review

|

Third party commentary and reporting in the media |

|

|

Expert reviewer (Professor Robert Buckle) noted: |

Articles on productivity related topics were published to reach a broad audience. The new Director has initiated a series of op-eds published by the New Zealand Herald and Stuff. These articles focus on issues pertinent to the role of the Commission and signal the type of work undertaken by the Commission. This series has included articles on the benefits of innovation, competition and innovation, and education, written in a style that introduces readers to the role and work of the Commission. They have a potentially important role in communicating to a broad audience why productivity matters for welfare and what can contribute to higher productivity. This seems an excellent initiative and an opportunity to extend the reach of engagement beyond the research and policy community. |

Impact indicator: Levels of engagement and response with the Commission’s work increase

Feedback from our stakeholders and the wider community indicates the role our work plays in increasing the overall quality of analysis and advice on productivity issues.

Impact(s) - Levels of engagement with, and responses to, our work

|

Measure |

Assessment |

|---|---|

|

Productivity analysis and advice improves: • % of inquiry participants surveyed who agreed or strongly agreed that the inquiry had helped to set or lift the standard in New Zealand for high-quality analysis and advice on [the topic] |

6.3% strongly agreed 55.7% agreed |

|

• % of inquiry participants surveyed who agreed or strongly agreed that they will use the inquiry report as a resource and reference in the future. |

24.4% strongly agreed 39.7% agreed |

Immigration – Fit for the future inquiry process and final report

Assessment methods: Independent expert review, focus groups, survey

|

Productivity analysis and advice improvements |

|

|

Survey |

Most of the respondents either agreed or strongly agreed that the final inquiry report “focused on the issues most significant to the development of working-age immigration policy settings for NZ’s long-term prosperity and wellbeing”. 43.4% (36) agreed, and 21.7% (18) strongly agreed; 16.9% (14) disagreed; 10.8% (9) didn’t know; and 7.2% (6) strongly disagreed. In a subsequent question set, the largest proportion of those who responded gave positive responses to the following statements: • The inquiry was sufficiently bold in reaching its findings and recommendations: 46.2% (36) agreed; 21.8% (17) disagreed; 14.1% (11) strongly agreed; 10.3% (8) strongly disagreed; 7.7% (6) didn’t know. • The inquiry has helped set or lift the standard in New Zealand for high quality analysis and advice on improving working age immigration policy settings for New Zealand’s long-term prosperity and wellbeing: 55.1% (43) agreed; 20.5% (16) disagreed, 11.5% didn’t know. The options for the terms strongly agreed or strongly disagreed both received 6.5% (5) each. |

|

Expert reviewer commentary on the extent to which the research work: Helped set or lift the standard in New Zealand for high-quality analysis and advice on [the topic] |

|

|

Expert reviewer (Richard Bedford) noted: |

I am impressed by the extent and range of public consultation that the Commission undertook following receipt of the ToR for the immigration inquiry in April 2021. With regard to the conduct of the engagement meetings, many of the early ones involved groups in round-table discussions with members of the inquiry team. The discussions were designed to inform the framing of the issues paper. Those academic colleagues and members of Ministries I contacted reported that these meetings were very open and constructive discussions. Genuine interest in getting ideas and feedback relating to the questions in the issues paper was apparent to participants in the panel discussions. |

|

Focus group commentary on the extent to which the research work: Helped set or lift the standard in New Zealand for high-quality analysis and advice on [the topic] |

|

|

Focus group |

There was general agreement that the Commission’s inquiry had lifted the standard of analysis and advice on immigration policy: “Yes, most definitely the inquiry lifts the standard.” “The report is of a higher standard than seen before.” While one participant said that her organisation had always had good access to MBIE data, another was very appreciative of the data made available through the inquiry: “It’s good to see data being available to everyone.” Another perspective was that it was hard to know whether the inquiry lifted the standard. “Prior analysis was carried out by MBIE behind closed doors, so it wasn’t possible to compare it with what the Commission had produced.” |

|

Expert reviewer commentary on the extent to which the research work: Contributes to future work on [the topic] being better focused and use resource more effectively |

|

|

Expert reviewer (Richard Bedford) noted: |

To ensure that immigration policy is “fit for the future”, the Commission argues that a range of absorptive capacity issues must be addressed, along with how best to reflect Te Tiriti o Waitangi in immigration policy and institutions. To achieve this, the Commission recommends establishing an immigration Government Policy Statement (GPS) to improve the quality and transparency of immigration policy. A major contribution of the Commission’s immigration inquiry has been to ‘red flag’ a number of key issues, such as absorptive capacity, that Ministries need to consider and address, rather than trying to do all the thinking for the Ministries. In this sense, Immigration – Fit for the future and the other reports and working papers that have been produced during the course of the Immigration inquiry have made a particularly valuable contribution that extends well beyond the domain of immigration policy settings. |

|

Focus group commentary on the extent to which the research work: Contributes to future work on [the topic] being better focused and use resource more effectively |

|

|

Focus group |

One participant suggested the Commission could usefully do a second immigration inquiry. “This would look at the labour market impacts of recent immigration policy changes, and the opening of the border, over the coming two years. It could also analyse what happens to migrant workers six months and two years post-immigration." A number of people, including those who had been somewhat disappointed with this inquiry, voiced strong support for the ongoing work of the Commission: “Keep on consulting us and other stakeholders. We fully support the Commission’s work.” |

|

Quality of analysis and advice in the inquiry and if inquiry reports will serve as a resource and reference in the future |

|

|

Survey |

In the survey, 39% of the survey respondents (30) agreed with the statement “I will use the inquiry reports as a resource and reference in the future”, with 24.7% (19) strongly agreeing. |

|

Expert reviewer (Richard Bedford) noted: |

A major contribution of the Commission’s immigration inquiry has been to ‘red flag’ a number of key issues, such as absorptive capacity, that Ministries need to consider and address, rather than trying to do all the thinking for the Ministries. In this sense, Immigration – Fit for the future and the other reports and working papers that have been produced during the course of the immigration inquiry have made a particularly valuable contribution that extends well beyond the domain of immigration policy settings. |

|

Focus group |

All participants agreed that the Commission’s inquiry documents would be a reference and a resource in future: “We will certainly use the report to help in understanding the labour market and when we make submissions on future immigration changes.” Ongoing work that would likely benefit from the report and its findings included Regional Skills Leadership Groups, Workforce Development Councils, and the development of Industry Transformation Plans. A number of those outside Government had already used the inquiry material in related work: “We have already used the report to help put together a Select Committee submission and we will continue to use it.” “Absolutely the research is becoming a source of direction for policy.” Another participant said they had already taken actions because of the report, which had led directly to specific projects coming to fruition. However, participants didn’t want the report to be just a reference. They wanted to see it used by MBIE and ministers to create policy. |

Biennial review of Economics and Research team

Assessment methods: Independent expert review

|

Productivity analysis and advice improvements |

|

|

Expert reviewer (Professor Robert Buckle) noted: |

The Commission has increased the quality of engagement and collaboration with other stakeholders, particularly those in government policy agencies. The reviewer commented on the re-activation of the Productivity Hub, with information about its activities now available online and open to Government and non-government researchers. He also considered the initiative to “successfully resuscitate” engagement with the Government Economics Network and related research and policy groups within the public sector. |

Output measurement: Right focus

Immigration – Fit for the future inquiry process and final report

Assessment methods: Independent expert review, focus groups, survey

|

Relevance and materiality of inquiry report |

|

|

Participant survey – Inquiry participants surveyed who agreed or strongly agreed that: |

|

|

The Commission sourced all relevant research and information |

47.1% agreed 18% strongly agreed |

|

The Commission engaged with the right people |

39.8% agreed 13.3% strongly agreed |

|

The final report/ research paper(s) focused on the issues most significant to [the topic] |

22.6% agreed 42.9% strongly agreed |

|

The final report went into sufficient depth on the issues it covered |

42.9% agreed 17.9% strongly agreed |

|

Focus group |

|

|

The Commission sourced all relevant research and information |

The inquiry report, according to one group member, had provided medium and long-term solutions that contrasted with the Government’s ‘band-aid’ or short-term responses to immigration issues. Another thought that the inquiry had reinforced an overdue need for our immigration settings to be simplified. This didn’t come so much from the inquiry itself, but from individuals describing the application process, visa criteria and so on: “It seems to be atrociously complex.” “If the inquiry achieves simplification that will be excellent.” |

|

The Commission engaged with the right people |

While most people agreed that the engagement was very good, some participants felt that the consultation process could have reached further and captured more voices: “I felt the engagement was very good – I just wondered whether everyone had a chance to be involved.” For example, one person mentioned that some of the smaller unions could have made useful contributions but didn’t appear to have been included. Another mentioned that, ideally, the engagement would have involved a wider range of overseas business interests including fund managers, investors in NZ-based SMEs and listed companies, and the philanthropic sector. Potentially, these parties could have been brought together in one group to engage. |

|

The final report/ research paper(s) focused on the issues most significant to [the topic] |

There was a lot of support for the Commission’s final report, and the findings and recommendations it put forward. “This was an essential investigation, and it was covered well.” However, one participant commented that, in practice, it had a narrower scope that focused on work visas. The inquiry report would have been more useful had it delivered on the wider scope indicated in the Terms of Reference. There was a second aspect in which the inquiry was seen as too narrow by one interviewee: “I felt that the review itself took an almost exclusively economic reading.” This person felt that the inquiry treated migrants as a pool of ‘short-term optional economic units’, used to plug gaps and make money for New Zealand businesses and the education sector. The many submissions with an international focus had reflected a much broader view of the importance and role of immigration, but they didn’t think this had come through into the final report. “We [my organisation] felt that the Terms of Reference recognised a much wider range of factors that are critical for the two-way movement of people.” |

|

The final report went into sufficient depth on the issues it covered |

This question was not asked of the focus groups. |

|

Relevance and materiality of paper(s) within the research work reviewed and the final inquiry reports |

|

|

Expert reviewer (Richard Bedford) noted the extent to which:

the paper(s) focused on the issues most significant to [the topic] and went into sufficient depth on the issues it covered. |

The ToR covered a much wider range of topics and issues than had been suggested by the Commission. The Commission is to be commended for developing such a well- designed and attractively presented invitation to a wide range of stakeholders, including the general public, to make submissions on aspects of the immigration inquiry between June–December 2021. Just over 40% (15) of the 35 bullet points relate specifically to economic dimensions of migration, especially regarding the labour market (e.g., demand, wages, inclusion, ‘crowding out’), skills and education, business investment and incentives, and a range of adjustments relating to enhanced productivity, infrastructure provision (including housing) and macroeconomic phenomena such as interest and exchange rates and GDP growth. (The E&R team were embedded in the Immigration inquiry to conduct research for the inquiry. Therefore, the inquiry reviewer also looked at the E&R team’s contribution to this inquiry.) |

Biennial review of Economics and Research team

Assessment methods: Independent expert review

|

Relevance and materiality of E&R work |

|

|

Independent expert reviewer (Professor Buckle) noted: |

With the support of the Board and additional financial support, the Commission had been able to “markedly improve the level of research experience, skill and capacity”. However, he also provided feedback from interviews of economists and researchers on the most relevant issues: “Some people interviewed thought the ERT could build on the excellent research and, as additional projects, identify how the insights could guide policy settings. Others argued that the ERT should concentrate on fundamental research on key issues associated with productivity and that it should be the responsibility of PC inquiries and relevant policy agencies to convert this research into appropriate guidance for public policy and management practice of firms.” In an in-depth review of the report Export challenges and responses of New Zealand firms, Prof Buckle noted: “This was collaborative work with New Zealand Trade and Enterprise and Text Ferret. The review noted the innovative approach of using a text mining approach, but that there was very little discussion of the selection bias, particularly explaining it for the wider audience for this paper including the policy community.” |

Output measurement: Good process management

Immigration – Fit for the future inquiry process and report

Assessment methods: Independent expert review, focus groups, survey

|

The extent to which inquiry issues papers, draft reports and final reports were delivered to schedule |

||

|

All external milestones communicated in the Commission’s process planning are achieved: • Inquiry processes • Research processes |

All external milestones communicated in our planning in inquiry and research processes were achieved. Milestones were monitored and reported in our triannual reporting to the Board and Ministers. |

|

|

Participant satisfaction with the inquiry process |

Inquiry participants surveyed who strongly agreed or agreed that overall, they were satisfied with the Commission’s inquiry process: |

17.1% strongly agreed 65.8% agreed |

|

Summary comments from focus group |

All participants thought that the Commission’s process had worked well. When providing input to the inquiry, focus group members had been given the opportunity to comment at multiple stages. The Commission had provided them with both the information they needed, and enough time to participate effectively. |

|

|

Summary comments from expert reviewer (Richard Bedford) |

Between June 2021 and April 2022, the Commission prepared 10 research papers as part of the immigration inquiry. Most of these papers were subjected to external peer review and nine of them are available on the Commission’s website. In addition, six substantive inquiries into specific issues linked with productivity and wellbeing dimensions of migration were commissioned from external research providers and most are available on the Commission’s website. For most of the time during the 11 months between June 2021 and April 2022 no more than six staff were working on the immigration inquiry. Release of wide range of research reports, in addition to an issues paper, a draft report and the final report, is impressive for a small staff. |

|

|

Satisfaction with the Commission’s management of research processes |

Participants in the Commission’s research process surveyed who agreed or strongly agreed that overall they were satisfied with the Commission’s approach: |

17.1% strongly agreed 65.8% agreed |

Biennial review of Economics and Research team

Assessment methods: Independent expert review

|

The extent to which inquiry issues papers, draft reports and final reports were delivered to schedule |

|

|

Independent expert reviewer (Professor Buckle) noted: |

There is a systematic work planning process in place developed in consultation with the PC Board and other stakeholders. There is now a systematic quality assurance process in place. There seems to be a stronger determination to seek peer review of ERT research through the refereeing of working papers, the presentation of research at academic conferences, and the publication of research beyond the PC website, including in peer reviewed research journals. |

|

Satisfaction with the Commissioner’s management of research processes |

|

|

Independent expert reviewer (Professor Buckle) noted: |

That with the support of the Board and additional financial support, the Commission had been able to “markedly improve the level of research experience, skill and capacity”. “a research management process has been implemented.” |

|

The degree of reviewer confidence in research findings and conclusions |

|

|

Independent expert reviewer (Professor Buckle) noted: |

There is now a systematic quality assurance process in place. There seems to be a strong determination to seek peer review of ERT research through the freeing of working papers, the presentation of research at academic conferences, and the publication of research beyond the PC website, including peer reviewed research journals. |

Output measurement: High quality work

Immigration – Fit for the future inquiry process and report

Assessment methods: Independent expert review, focus groups, survey

|

Confidence in inquiry findings and recommendations |

||

|

Participant confidence in the Commission’s inquiry findings and recommendations |

Inquiry participants surveyed who considered the following aspects to be of good or excellent quality: |

|

|

The inquiry’s analysis of information |

18.5% excellent 43.2% good |

|

|

The findings and recommendations |

12.3% excellent 44.4% good |

|

|

Inquiry participants surveyed who agreed or strongly agreed that: |

||

|

The Commission’s recommendations followed logically from the inquiry analysis and findings |

19% strongly agreed 58.2% agreed |

|

|

The Commission’s recommendations would, if implemented, materially improved performance in [the topic area] |

18.8% strongly agreed 42.5% agreed |

|

|

Summary of focus group |

||

|

Focus group summary of whether they considered the following aspects to be of good or excellent quality: |

The inquiry’s analysis of information |

Several comments were made on the quality of the data and analysis – one participant talked about how difficult it was to analyse immigration patterns before the Commission put out information and analysis as part of the inquiry. “We used to be reliant on flow numbers and had to read multiple reports to analyse what was happening in the labour market.” “The way they analysed immigration by industry was really important for improving understanding.” However, there were contrary views about quality, with one person saying: “The Commission has an excellent reputation, so this felt like a lighter and more targeted approach, with a process that was quite different to what we’ve seen previously.” |

|

The findings and recommendations |

The recommendations were supported by most participants, with positive comment being made about recommendations specifically addressing:

|

|

|

Focus group summary of whether they agreed or strongly agreed that: |

The Commission’s recommendations followed logically from the inquiry analysis and findings |

“While the recommendations were really useful and important, they lacked a compelling, driving single argument for a major overhaul.” |

|

The Commission’s recommendations would, if implemented, materially improve performance in [the topic area] |

People were looking for more acknowledgement of, and response to the inquiry from both the Government and MBIE. Decisions on sector workforce agreements and the Green List had cast doubt over how much influence the inquiry would have. “Immigration NZ isn’t referencing the inquiry.” |

|

|

Expert review commentary – Richard Bedford |

||

|

Participant confidence in the Commission’s inquiry findings and recommendations |

Inquiry participants surveyed who considered the following aspects to be of good or excellent quality: |

|

|

The inquiry’s analysis of information |

Question not asked of expert reviewer. |

|

|

The findings and recommendations |

Question not asked of expert reviewer. |

|

|

Inquiry participants surveyed who agreed or strongly agreed that: |

||

|

The Commission’s recommendations followed logically from the inquiry analysis and findings |

Question not asked of expert reviewer. |

|

|

The Commission’s recommendations would, if implemented, materially improved performance in [the topic area] |

Question not asked of expert reviewer. |

|

|

The degree of reviewer confidence in research findings and conclusions (The E&R team were embedded in the Immigration inquiry to conduct research for the inquiry. Therefore, the inquiry reviewer also looked at the E&R team’s contribution to this inquiry.) |

Reviewer commentary indicates the following aspect to be of good or excellent quality:

|

...I am impressed with the quality of the process that was adopted to meet the terms of reference for the immigration inquiry. I am also impressed with the inquiry’s four major outputs: the Issues paper, the draft report, the final report and the report (Immigration by the numbers) that contains much of the quantitative evidence that has informed the Commission’s findings and recommendations. The data presented in Immigration by the numbers provides support for several of the Commission’s headline statements about the inquiry that are on their website, including: “On average, immigration is not driving down wages nor displacing local workers.” |

|

Reviewer commentary indicates the following aspect to be of good or excellent quality:

|

Immigration by the numbers is, and will remain, a major resource for anyone interested in international migration in New Zealand. It is rare to find such a comprehensive and very readable report on immigration in New Zealand. The Commission’s Economics and Research team are to be commended on the high quality of both the presentation of data in this report. Immigration – Fit for the future is well written, has a clear and coherent structure, and is well-illustrated. Its content meets the requirements of the Minister of Finance in his letter of expectations in May 2021. A major contribution of the Commission’s immigration inquiry has been to ‘red flag’ a number of key issues, such as absorptive capacity, that Ministries need to consider and address, rather than trying to do all the thinking for the Ministries. In this sense, Immigration – Fit for the future and the other reports and working papers that have been produced during the course of the immigration inquiry have made a particularly valuable contribution that extends well beyond the domain of immigration policy settings. |

|

|

Reviewer agreed or strongly agreed that: |

|

The data presented in Immigration by the numbers provides support for several of the Commission’s headline statements about the inquiry that are on their website, including: “On average, immigration is not driving down wages nor displacing local workers.” |

Biennial review of Economics and Research team

Assessment methods: Independent expert review

|

Confidence in inquiry findings and recommendations |

|

|

Expert reviewer (Professor Robert Buckle) noted: |

The review found that the team “is perhaps the strongest it has been for several years.” “Despite capacity pressures, the PC and ERT have been active in presenting research papers at local research conferences. This has had the strong support of the PC Commissioners and involvement by one of the Commissioners, Professor Gail Pacheco. The topics of several of these research papers had a clear connection to the work on inquiries at the time.” For example, in his review of the report, Living on the edge: An anatomy of New Zealand’s most productive firms, Prof Buckle noted: “This work is of a very high quality. As some policy agency staff have remarked, this is a highly valuable “state of the art” source of information about the productivity of New Zealand firms. The data preparation, analysis and derivation of characteristics are meticulously documented and undertaken with rigour.” |

Output measurement: Effective engagement

Immigration – Fit for the future inquiry process and report

Research reports

Internally written research reports included six discussion papers to help those wishing to be better informed about a wide range of issues relating to immigration in New Zealand.

Draft and final reports

Learnings from engagement meetings and submissions, combined with further research, led to a significant change between the draft and final report. This included a refinement of and, in many cases, new findings and recommendations that would not have been possible without input from a wide range of stakeholders.

Immigration – Fit for the future inquiry process and final report

Assessment methods: Independent expert review, focus groups, survey

|

Confidence in inquiry findings and recommendations |

||

|

Participant perception of the quality of engagement by the Commission. |

Inquiry participants surveyed who agreed or strongly agreed that: |

In total, 91 people responded to the following statements: |

|

• There was ample opportunity to participate in the inquiry |

37% strongly agreed 45.7% agreed |

|

|

• The Commission was approachable |

32.2% strongly agreed 44.4% agreed |

|

|

• The Commission communicated clearly |

28.9% strongly agreed 51.1% agreed |

|

|

• The Commission understood their views |

21.1% strongly agreed 41.1% agreed |

|

|

Focus group perception of the quality of engagement by the Commission. |

One group member commented that “this Government is not known for the quality of its engagement on policy proposals” but said that the Commission’s work was an exception. Other feedback included: “This was the most solid piece of consultation I have seen in a long time.” “Certainly, the submissions reflected a wide range of organisations.” People who had been involved in face-to-face and Zoom meetings said the meetings had worked well and that staff at the Commission were both highly competent and good to deal with. Another person said that his engagement with the Commission over the report had been excellent. Where he had disagreed or didn’t understand something, the Commission did a good job of explaining and taking his input on board. The Commission’s engagement process was contrasted with the reference groups that are often used to gain stakeholders views. One participant commented that the Commission’s approach brought out the views of members of a range of organisations rather just the views of a few individuals on a reference group. |

|

|

Expert reviewer (Richard Bedford) comments on perception of the quality of engagement by the Commission. The Commission’s approach was a positive contribution toward improved levels of coordination and collaboration in productivity research. |